Statistics and Fundamentals

The Statistics and Fundamentals screen shows trading and financial data about the Underlying currently selected in the Underlying screen area (see here). Note that this data is "as of" the Trading Date and Time currently selected in the Trading Date & Time screen area (see here). However, only historical data is available - when running OptionNET Explorer in LIVE mode (when the Trading Date & Time is set to LIVE) the Statistics and Fundamentals data is not available. Finally it must be noted that a great deal of the available data is of primary use to non-index based Underlying's only - for example RUT options are based on an index of Stocks and are not tradable in their own right (there being no Stocks or Shares in RUT) and for this reason many of the data items are meaningless in the context of indexes, and therefore not populated by OptionNET Explorer.

It is hoped that the Statistics and Fundamentals can be used as an aid to investigate the trading and financial state of an Underlying, to examine its relative historical performance and perhaps to help in the determination of the Underlying's future prospects - information of great use to the Option trader.

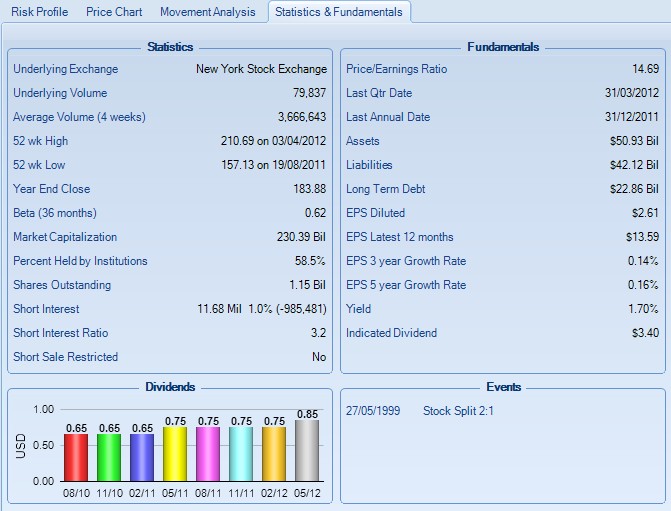

The following screen shots shows the Statistics and Fundamentals data for Underlying IBM (International Business Machines) as of a Trading Date of 17th May 2012:

The Statistics and Fundamentals display areas is composed of five main categories of data, each category detailing a number of relevant stats and indicators :

The information Categories of the Statistics and Fundamentals |

|

Category Name |

Description |

Statistics |

Trading Statistics of the Underlying - for more information see here. |

Fundamentals |

Company Financial Fundamental data - for more information see here. |

Dividends |

Dividend history - for more information see here. |

Events |

Events affecting the Shares in the Underlying - for more information see here. |

Trade Volume Analysis |

Trade Volume Analysis - for more information see here. |

The data fields of the Statistics Category |

|

Data Name |

Description |

Underlying Exchange |

The Financial Exchange on which the Underlying is traded. |

Underlying Volume |

The daily volume of the Underlying. |

Average Volume (4 weeks) |

The average daily trading volume over the last four weeks. |

52 week High |

The highest price achieved by the Underlying over the last 52 weeks and the date on which it occurred. |

52 week Low |

The lowest price achieved by the Underlying over the last 52 weeks and the date on which it occurred. |

Year End Close |

The price of the Underlying at the end of the previous Year trading. |

Beta (36 Months) |

Beta is a measure of the risk of the Underlying's stock when it is included in a well-diversified portfolio. |

Market Capitalization |

The total value of the tradable shares of the Underlying. |

Percent Held by Institutions |

The percentage of the stock in issue held by Institutions (as against private investors). |

Shares Outstanding |

The number of stock held by investors or institutions. |

Short Interest |

Quantity of underlying stock shares that have been sold short but yet not covered. Can be used as a market sentiment indicator. Also displayed as a percentage of Shares Outstanding. The figure in brackets is the change in Short Interest since last published. |

Short Interest Ratio |

Sometimes called "Days to Cover" and shows market sentiment. Calculated by dividing the Short Interest by the Average Volume and represents the number of days it takes short sellers on average to repurchase the borrowed stock. A "short squeeze" can occur if the price of a stock with a high Short Interest starts to experience increased demand and a strong upward trend. |

Short Sales Restricted |

Is there a restriction on the shorting of the Underlying's stock. |

The data fields of the Fundamentals Category |

|

Data Name |

Description |

Price Earnings Ratio |

The ratio of the Price of the Underlying's stock divided by its annual Earnings per Share (EPS). |

Last Quarter Date |

Last Financial Quarter Date |

Last Annual Date |

Last Financial Annual Date |

Assets |

The total value of all assets owned by the Underlying. |

Liabilities |

The total value of all liabilities held by the Underlying. |

Long Term Debt |

The total value of any debut held by the Underlying with a maturity longer than one year. |

EPS Diluted |

The underlying's Earnings per Share (EPS) calculated using all stock outstanding, stock option grants and convertible bonds. It is therefore the "worse case" EPS - in effect the EPS when all the Underlying's stock are in receipt of dividends. |

EPS Latest 12 months |

Earnings per Share (EPS) during the last 12 months. |

EPS 3 year Growth Rate |

The annualised growth rate of Earnings per Share (EPS) based on the last three years. |

EPS 5 year Growth Rate |

The annualised growth rate of Earnings per Share (EPS) based on the last five years. |

Yield |

The dividend paid in the previous financial year divided by the current share price. |

Indicated Dividends |

Total Dividends that would be paid on a share of stock throughout the next year if each dividend is the same amount as the previous dividend. |

The data fields of the Dividends Category |

|

Data Name |

Description |

Dividend Amount |

A bar chart showing dividend amount over time. |

The data fields of the Events Category |

|

Data Name |

Description |

Event |

Date and Description of an Event affecting the Underlying's Shares. |

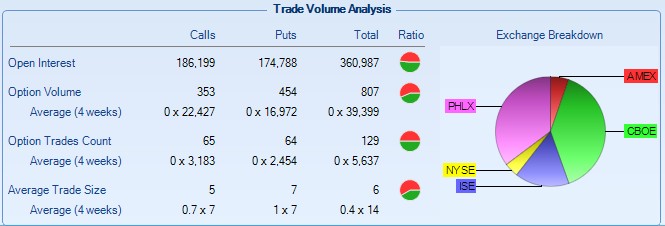

The data fields of the Trade Volume Analysis |

|

Data Name |

Description |

Open Interest |

The total number of Options that have not been settled: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. |

Option Volume |

Daily option volume: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. |

Option Volume Average (4 weeks) |

The 4 week average option volume: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. The multiple (figure before the "x") represents the number which when multiplied by the 4 week average option volume results in the daily option volume. |

Option Trade Count |

The daily Option Trade count: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. |

Option Trade Count Average (4 weeks) |

The 4 week Option Trade Count: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. The multiple (figure before the "x") represents the number which when multiplied by the 4 week average option trade count results in the daily option trade count. |

Average Trade Size |

The daily average trade size: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. |

Average Trade Size Average (4 weeks) |

The 4 week average trade size: Detailed by Calls, Puts, Total and Ratio of Calls to Puts. The multiple (figure before the "x") represents the number which when multiplied by the 4 week average trade size results in the daily trade size. |