Option Chain screen area

The Option Chain screen area is where the available Option Symbols and their Prices are displayed.

In order to display any data it requires prior selection of Trading Date/Time (from the "Home" menu item in the Ribbon screen area) and also prior selection of the Underlying vehicle (from the Underlying screen area).

In addition, this screen will show which (and the quantity) of Option Symbols you have in any currently selected Open Position.

In order to display this Position data it requires the selections above and the additional selection of the Open Position (from the Open Position screen area).

Finally, this screen allows you to create a new Position or to adjust an existing Open Position.

Creating or adjusting Positions is effected by selecting Option Symbols contract quantities and adding them to a "Model" to build up a Position proposal. This proposal or model can be analysed in the same way as we would analyse an Open Position, by using the tools available in the Analysis Tools screen area. Thus the effects of varying Option Symbol combinations and contract quantities on a new or existing Open Position can be investigated (or "modelled").

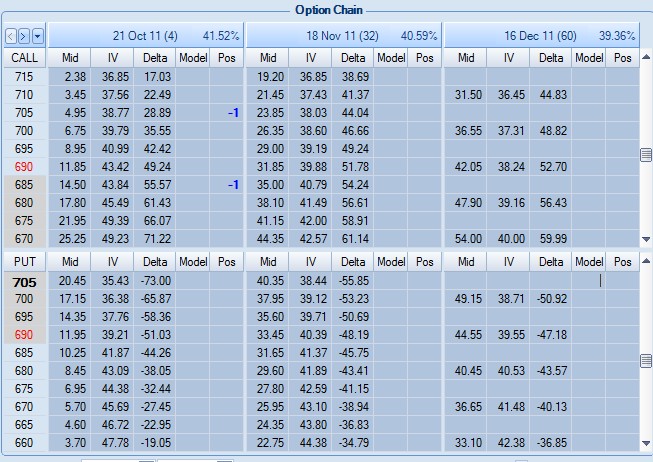

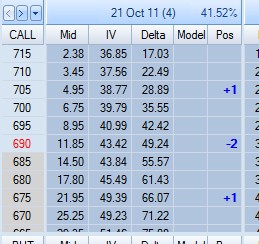

The following screen shot shows a typical Option Chain screen - in this example it details Oct, Nov and Dec 2011 Option Symbol Strikes for the RUT underlying as of Monday 17th October 2011 at the end of the day:

Note that the Option Chain area displays data in a two dimensional scrollable grid with the different expiration months available running left to right and the option strike prices running up and down - with the top half of the whole grid displaying Call strikes and the bottom half displaying Put strikes.

When back-testing - and thus using historical prices - all option strike prices will be appear black in color. However, when showing live prices - and thus subjected to market driven changes - the option strike prices will appear black, blue or red in color depending upon if the individual price is unchanged, increasing or decreasing respectively, compared with its previous tick price.

The values in the column named "Pos" (short for Position) are the quantities of contracts for the respective Option Symbol Strike that have been added to the Open Position (how these values are added to the Open Position - via the "Model" - is discussed below).

Finally note, on the top header line can be found information about each expiration month. This information is of the form:

Expiration Date (Number of days left to expiration) Implied Volatility of the Option Series

For example, "18 Nov 11 (32) 40.59%" as in the following screen:

This indicates that the Option Series below the header has an expiry date of 18th November 2011 with 32 days left to expiration and the current Implied Volatility for the series is 40.59%.

ONE is not displaying your Position as you expect?

Check that you have selected the correct Account, Trading Date/Time, Underlying vehicle and Open Position.

ONE is not displaying the Strikes or at the prices you expect?

Check that you have selected the correct Underlying vehicle and Trading Date/Time

Check that the Underlying hasn't undergone a "reorganization" - such as a Stock Split - please refer to the Statistics and Fundamentals tab on the Analysis Tools screen area (see here) for further details. Such reorganizations can profoundly changed the reported Underlying and Strike prices. (though do not necessarily affect the overall financial situation).

Note that OptionNET Explorer does not currently automatically process Split Stock - the only way to handle a stock split is by manually closing the position on the day before the split and then reopening the same position on the day of the split at the new ratio (to reopen a closed Position see here).

The Option Chain screen area allows you browse available Strikes and get information about them.

To help with this, please note the screen control situated in the top left hand corner of the Option Chain screen, as shown in the following screen shot:

This control has three options or icons:

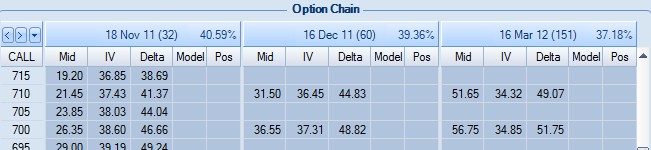

The first two icons - arrow left and arrow right - allow the user to scroll back and forth through the various Expiration Dates available. For example, if the Option Chain grid is currently showing Oct, Nov and Dec 2011 Strikes, as shown in the following screen shot:

...then pressing the forward arrow (the second icon) will shift the displayed Strikes to Nov, Dec 2011 and the next Expiration Strike at Mar 2012.

Pressing the backward arrow will then restore the display to Oct, Nov and Dec 2011 Strikes.

In addition, it is possible to scroll up and down to see the other available strikes (only those Strikes nearest to the current Underlying Price are shown by default) by using the scroll bar at the right hand side of the screen area:

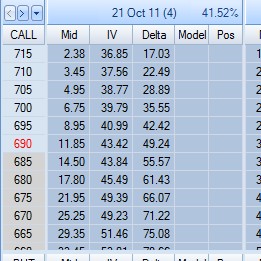

Note that for each Expiration and Strike there are five fields displayed:

The data items displayed on the Option Chain |

|

Data Item Name |

Description |

Mid |

The Mid price of the Option Symbol. The middle point between the Bid and Ask price of the Option Symbol. |

IV |

The calculated Implied Volatility. A measure of how much the Option Symbol price is subject to change. A low IV indicates that the price is relatively stable, while a high volatility indicates that the price is subject to large swings. |

Delta |

Configurable - see below. Default field is "Delta". |

Model |

Used to add a quantity of contracts to the "Model". Positive numbers = contracts Bought. Negative numbers = contracts Sold. |

Pos |

The number of Option Symbol contracts that already exist in the currently selected Open Position. Positive numbers = Buy. Negative numbers = Sold. |

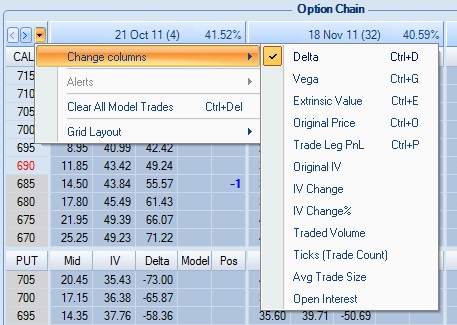

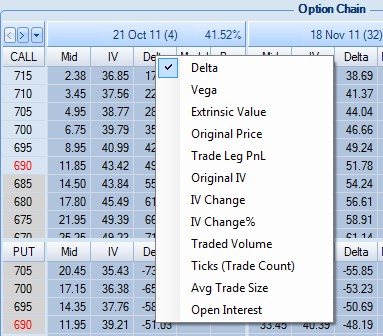

The third icon allows the user to select a field for display in the configurable column as introduced above. By pressing the third icon you are able to select which field you want to see displayed in this third column, as shown in the following screen shot:

The configurable column can also be changed by clicking on its column header, as shown in the following screen shot:

The available data fields for display in the Option Chain |

|

Data Item Name |

Description |

Delta |

One of the Greeks - a measure of the sensitivity of the price of an option to changes in the price of the Underlying. |

Vega |

One of the Greeks - a measure of the sensitivity of the price of an option to changes in volatility. |

Extrinsic Value |

The time value of the Option. |

Original Price |

The price of the leg when the position was opened (only appears if you have an open position at that strike/expiration cycle). |

Trade Leg PnL |

The Profit or Loss of that option since the leg was opened in the Position (only appears if you have an open position at that strike/expiration cycle). |

Original IV |

The Implied Volatility of the leg when the position was opened (only appears if you have an open position at that strike/expiration cycle). |

IV Change |

The change in the Implied Volatility of that option since the leg was opened in the Position (only appears if you have an open position at that strike/expiration cycle). |

IV Change% |

The percentage change in the Implied Volatility of that option since the leg was opened in the Position (only appears if you have an open position at that strike/expiration cycle). |

Traded Volume |

The number of option contracts currently traded on all exchanges. |

Ticks (Trade Count) |

The number of trades reported by the exchange. |

Avg Trade Size |

The Average Trade Size. |

Open Interest |

The total number of option contracts that are currently open. This value is reported by the exchange and updated after market close. It is not updated through the trading day. |

The importance of the Option Chain screen area lies in its ability to allow you to model individual trades to build up a trading position.

A Model is built consisting of Option Symbol Strikes by entering a number of contract quantities in the corresponding "Model" cell - this allows for modelling or simulating a strategy. The effect of the Model on the Open Position as a whole can be gauged by referring to automatically updated statistics in the Trade Analysis screen area or from the charts in the Analysis Tools screen area.

If you decide the Model is acceptable as an adjustment to the currently selected Open Position then it can be "Committed" - effectively moving the number of contracts for the Option Symbol in the Model column to the Position column.

First select the Option Symbol Strikes you want to add into the Model (this example is a new position but the processing is the same when amending an existing Position except that you would first select an existing Position from the Open Position dropdown control):

In the Model column add the number of contracts for each Option Symbol Strikes you wish to include in your simulated Position:

In the example above, we have are simulating and Call Butterfly strategy by selling 2 contracts of the 690 October Calls, buying 1 contracts of the 705 Calls and 1 contract of the 675 Calls in the same expiration month.

If you are happy with the Model and wish to add it to the Position then press the "Commit Trade" button in the "Home" menu item in the Ribbon screen area:

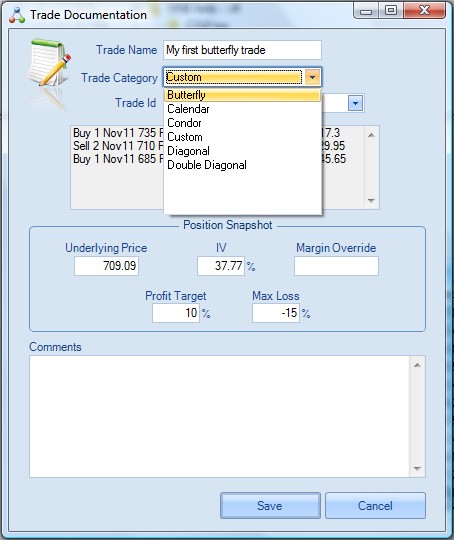

You will then be presented with the following "Trade Documentation" screen where you can enter further information:

Because some of the actual trade details cannot be known to ONE (for example, at the time of trading with your broker the Underlying price may differ from that as suggested by ONE when you come to Commit the Trade) we therefore have the ability to overwrite the default Position Snapshot values.

The data items displayed on the Trade Documentation screen |

|

Data Item Name |

Description |

The descriptive name used to identify this Position. |

|

The type of Position. Use the dropdown list to select the Position that most closely represents your trading strategy. |

|

If the Position is new then this is set to "Start New Trade" otherwise it will be set to the Trade Id of the Open Position being modelled. Important: You can change the Trade Id on the Trade Documentation screen to any existing trade, open or closed. When selecting a closed Position you are effectively re-opening that Position. The Trade Id is your unique Trading Position identifier. Each time you create a new Position, regardless of which Account or Underlying you are working in, the new Position is allocated a Trade Id that is sequentially generated by the software. |

|

Option Symbols |

The individual trades making up the (intended) Position. Display only. |

Position Snapshot |

Various data items related to the (intended) Position. |

Comments |

Any comments that you feel are relevant to the trade. This is a good place to record your reasons for making the trade or any subsequent adjustments you make. Displayed in the Risk Profile on the Analysis Tools screen area if configured. |

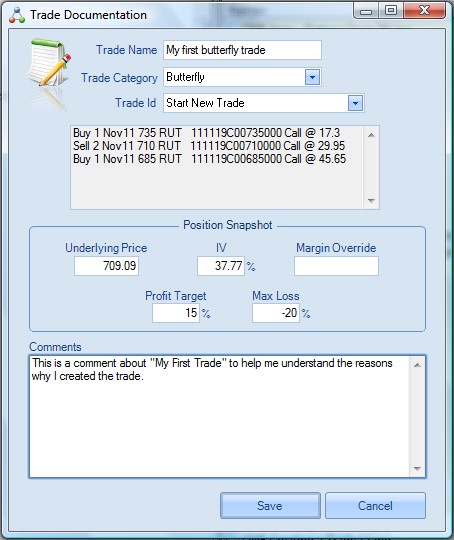

For example, a completed Trade Documentation screen may look something like this:

On pressing the "Save" button, the Option Symbol Strikes contracts in the Model column will be transferred to the Position column, thus creating the Position:

When entering the Model trades there are some useful shortcuts available which are accessible by clicking on the Model column header:

These features are described below:

The shortcuts available in the Option Chain Model Column |

|

Shortcut Name |

Description |

Enter Closing Model Trades |

ONE determines which trades are required to close the current Position and populates the Model with said trades. If trades have already been entered into the Model, then those trades will have to be cleared first before ONE can enter the closing trades. |

Clear All Model Trades |

Clear all trades in the Model columns thereby deleting the proposed adjustment. |

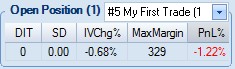

And finally, the Open Position, Trade Analysis and Analysis Tools screen areas will be updated to reflect the new or adjusted Position:

This is how the Trade Analysis section might be updated to show the new Position:

Note that the name of the Position has been prefixed by "#5": this means that it has been allocated a Trade Id of #5.